Italian fiscal code for foreigners (Codice Fiscale) – A Short Guide

What is an Italian tax code (codice fiscale)?

For foreigners who want to buy property in Italy, it is important to know what the fiscal code is.

The Italian fiscal code or codice fiscale is an alphanumeric 16 character code generated on the basis of your personal information.

An Italian tax code is similar to a National Insurance number in the UK or Social Security number in the USA. It uniquely identifies individuals for Italian tax and administrative purposes.

Having a codice fiscale is a mandatory requirement for a wide range of activities in Italy. These include signing a property purchase, tenancy contract or inheriting Italian assets.

In addition, you will need a codice fiscale in order to open a bank account or apply for a mortgage. Obtaining utilities, insurance policies and of course, filing tax returns and payment also require your codice fiscale.

If you need help concerning an Italian tax code you can book a Free Call with one of our Lawyers.

How do I get an Italian tax code?

From abroad

If you live abroad, you can apply for an Italian tax code at the relevant Italian consular office in your country of residence.

Need Your Codice Fiscale Because You're Buying an Italian Property?

Don't miss out on your FREE copy of our full guide on Buying a Property in Italy

Download nowIn Italy

If you are an EU citizen living in Italy, you can apply for an Italian tax code at any office of the Agenzia delle Entrate (Italian Revenue Agency). You will need to fill in an application form and provide an identification document (identity card or passport).

If you are a non-EU citizen applying for entry into the Country either for employment purposes or to live with family, you can obtain your Italian Tax code at your local “Sportello Unico per l’immigrazione” (Immigration office). Or, you can apply at a “Questura” (Police headquarters) if you need the issuance or the renewal of a residence permit.

Non-EU citizens must also prove that they have the right to stay, even temporarily, in Italy.

For more information regarding Italian tax codes, you can visit the Official Italian Ministry of Economy and Finance website

What do the codice fiscale characters mean?

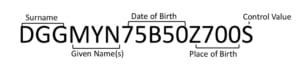

Here is an example of a codice fiscale for Mary-Ann Duggan, born 10th February, 1975 in Melbourne, Australia.

Name

Where the letters in your surname and given name(s) permit, the consonants form the first six characters of the tax code. When you apply for a codice fiscale make sure your given name(s) and surname match your passport. For example, if your name is Mary-Ann Duggan but, your passport shows your name as Mary A Duggan, your application for your Italian tax code should match the information in your passport.

Date of birth

In a codice fiscale, birth information starts with the year. 75 indicates 1975 in our example for Mary-Ann Duggan. B indicates February. This is Mary-Ann’s birth month. Each month has an assigned letter:

Mary-Ann Duggan was born on the 10th. The code that appears is 50. This is because for males, dates run from 01 through 31 to indicate birth day. Whereas for females, 40 is added to calendar days. This therefore becomes 50 in Mary-Ann’s codice fiscale.

The sequence regarding the place of birth indicates where an individual was born. For Italian nationals, each Italian municipality / comune has its own code. For foreign nationals, this will be their country code.

Generally, a foreign country is identified by a sequence starting with “Z”. In Mary-Ann Duggan’s case, Z700 indicates Australia. There is only one code per country. In other words, if you are from Australia, whether you were born in Cairns or Perth, there is only one single identity code for Australia.

The last letter in the codice fiscale is a control value. The Italian tax system generates this value based on a calculation of all the characters contained in a codice fiscale.

When you apply for your tax code, avoid common mistakes

Birth date format

Whereas in Italy for date of birth, we use day/month/year, in some countries, such as the USA, this information is usually month/day/year. Using the wrong format generates an incorrect tax code. This is an issue, since Italian databases will reject the registration of information requiring tax code and identification of date of birth. Often, this issue only becomes apparent at completion or closing of a property purchase. This can delay closing while you apply for a corrected tax code.

Wrong name

As previously mentioned, the name in the tax code must match your ID – passport for example.

Maiden names

Maiden names are the most common error we see when it comes to females applying for an Italian tax code. This mistake can have consequences if you need to use notarial services, for example, when purchasing an Italian property. The notary may not be able to complete the purchase if your name does not match your ID.

Another common error can occur with maiden names. Italian females may use their spouse’s family name, however for legal purposes, they retain their maiden name after entering into marriage or a civil partnership.

Non-Italian females generally change their name when they marry and update their passports and other ID to reflect their married name. Again, the tax code must match the information in your passport.

Finally

We understand that Italian tax code matters can be confusing and difficult to navigate. If you have any questions about what action you should take or if you need help concerning an Italian tax code, please get in touch with us.

You may also be interested in another one of our articles: How Do UK Nationals Obtain Permanent Italian Residency?

You may also like to watch our info videos.

Get All Our FREE Guides for Foreigners Planning to Buy, Sell or Live in Italy

Our PDF guides give you all the knowledge you need to move your Italian dream forward with confidence

Download now